General Finance

All Categories

If you prefer to do all your banking from the comfort of your home and don’t mind not having access to face-to-face help if required,…

Read Full Article >>Is Questrade Safe & Secure? One of the most common questions that I have gotten in the comments below is: Is investing my money through…

Read Full Article >>An RESP, or Registered Education Savings Plan, is a registered tax-deferred investment account designed to help pay for a child’s education. In other words, RESPs…

Read Full Article >>Welcome to the annual Registered Education Saving Plan (RESP) update where I show transparency on our indexed investment strategy to help pay for our children’s…

Read Full Article >>Readers often ask what my favourite personal finance apps are. It’s not an easy question to answer, as the apps we choose are highly personalized…

Read Full Article >>Most Recent

Tax-Loss Harvesting in Canada

Tax-loss harvesting helps Canadians minimize the taxes that they pay on investment gains made outside of their RRSP and TFSA. What Canadian doesn’t want to…

EQ Bank vs Simplii Financial

EQ Bank is one of our most frequently recommended banks; we’ve even granted it first place in our list of top-rated Canadian online banks. Simplii…

Life Insurance for Seniors in Canada

Is permanent life insurance a good investment for Canadian retirees? Is whole life insurance the secret to building “infinite banking wealth” as I keep seeing…

Trump, Tariffs, and the Canadian Economy

Here we go again… the Trump economy rollercoaster is full speed ahead. Many Canadians are anxiously glancing at their portfolios and trying to parse the…

Qtrade Guided Portfolios Review

What is Qtrade Guided Portfolios? (Formerly VirtualWealth) Qtrade Guided Portfolios is the new robo advisor put out by our #1 rated online brokerage company Qtrade.…

Canada Personal Pensions: Defined Benefit vs Defined Contribution Plans

Two of our most well-read articles here on MDJ cover the “government pension” that consists of CPP and OAS. In order to give the most…

Best Personal Finance Courses in Canada

I need to be clear right off the bat that I’m a bit bias when it comes to recommending the best financial literacy courses in…

Canadian Financial Summit 2024

It’s that time of the year… the leaves are falling, pumpkin spice lattes are brewing, and for MDJ’s Kyle Prevost – it’s back to the…

13 Top Tax Breaks for Seniors in Canada

There are a ton of tax breaks for seniors in Canada compared to other age groups. It’s almost like our tax code tells us the…

RBC InvestEase Review 2025

What is RBC InvestEase? Some people prefer to stick with the familiar and trusted, especially when it comes to choosing a robo advisor – and…

The Best Investments for Canadian Retirees: Stocks vs ETFs vs Robo Advisors

When discussing the best investments for Canadian retirees it’s important to understand upfront that it’s a nuanced topic. There is no one-size-fits-all silver bullet answer…

Neo Financial Mastercard Review 2025

The new Neo Financial Mastercard or “Neo MastercardTM” is the next big thing in Canadian credit cards. We’ve seen tech companies disrupt everything from vehicles…

Oaken Financial Review

What is Oaken Financial? Oaken Financial is a digital bank owned by Home Trust Company, which is a subsidiary of Home Capital Group Inc. (one…

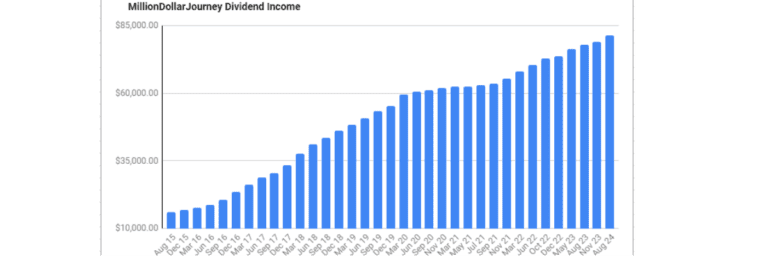

Financial Freedom Update August 2024 – $81.5k in Dividend Income!

Welcome to the Million Dollar Journey August 2024 Financial Freedom Update – the first update of the year! If you would like to follow my whole financial…

Best Recession Stocks in Canada for 2025

With Canadian dividend stocks facing significant pressure this year, many readers are asking me what are the safest stocks in Canada right now. Given the…

How Much Do Canadians Spend In Retirement?

You’d think it’d be a relatively easy quest to answer the question: How much will a Canadian spend in retirement? When I set out to…

HSBC Expat Bank Account for Canadians Abroad and Internationals in Canada

What is HSBC Expat? HSBC Expat banking is a British-headquartered bank that tailors its services to folks who aren’t living in Canada and seek to…

EQ Bank vs Neo Financial

EQ Bank continues to hold its place as our top rated online bank in Canada, but have you ever heard of Neo Financial? In the…

"I've completed my million dollar journey...

Want some help with yours?”

Instantly download our free eBook on tips for how to organize your RRSP, TFSA, and other investments, in order to get the most out of your retirement at any age.