Retirement

All Categories

The concept of a safe withdrawal rate (and the 4% rule) is a key planning tool for Canadians of all ages. After all, if you…

Read Full Article >>I recently received an email from a reader with a bright financial future. They have a maxed out TFSA and has recently maxed out her…

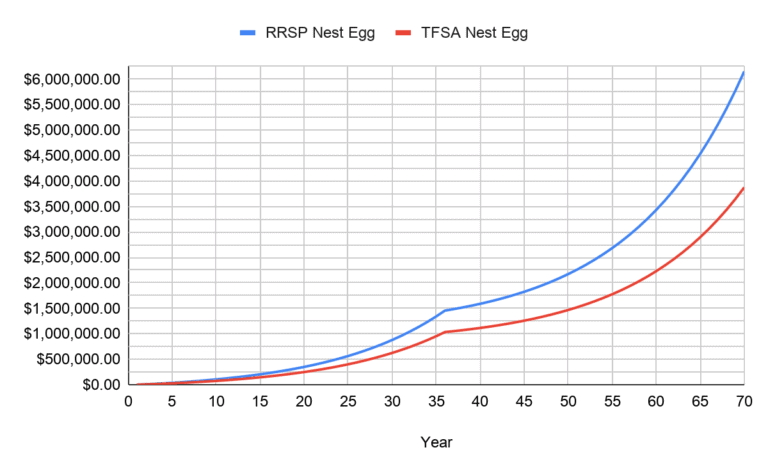

Read Full Article >>When I initially wrote this article about building RRSP wealth in your 30s, 40s, and 50s, my goal was to create an easy visual that…

Read Full Article >>After writing a deep dive article on whether the 4% safe withdrawal rate still works for retirement at various ages, I received a lot of…

Read Full Article >>This popular article was originally written in 2017, but since then, a couple of the calculators have gone offline. I have updated this article with…

Read Full Article >>Most Recent

How Much Do Canadians Spend In Retirement?

You’d think it’d be a relatively easy quest to answer the question: How much will a Canadian spend in retirement? When I set out to…

RRSP vs IPP for Canadian Business Owners

In my recent articles about paying yourself in salary vs dividends from a CCPC, as well as investing within a Canadian corporation, we explored the…

Selling a Business to Retire in Canada

I’ve been on a real small business/CCPC kick here at MDJ over the last month, and my end goal was always to get to a…

Investing Inside a Corporation for Retirement in Canada

Before you jump into the details of investing inside of a corporation for your retirement, it’s likely worth taking a few minutes to read my…

How to Become a Millionaire in Canada

Most of us have wondered what it takes to reach millionaire status in Canada. We certainly don’t advise getting involved in any “get rich quick”…

Salary vs Dividends in Canadian Corporations: Paying Yourself as a Small Business Owner

In preparation for our dividends vs salary comparison for Canadian small business owners, we took a broad look at Canadian corporate taxes last week. I…

Home Equity in Retirement – Reverse Mortgages vs HELOCs vs Downsizing

Many retiring Canadians have a huge chunk of their net worth tied up in their housing equity. Deciding whether to tap into that housing equity through…

Managing Money In Retirement – Investing with Cognitive Decline

Since writing Canada’s first online course that looked at how to create a DIY financial plan for your retirement, I’ve gotten a few inquiries about…

OAS in Canada: Clawbacks, Eligibility and Payment Dates

Old Age Security – better known as OAS – is one of the least understood aspects of Canadian retirement planning that I’ve come across. In…

CPP Ultimate Guide – Eligibility, Payment Dates, Withdrawals & More

Most Canadians know the Canada Pension Plan as a government account they pay money into every month when they are working, and then when they…

Retirement Planning in Canada (RRSP Season)

With “RRSP season” and annual financial goal setting in full swing, Canadian retirement planners are out there in full force ready to “help”. Honestly, the…

Investing in Annuities in Canada – Buying a Pension for Life

As a former teacher you might think I’d be the last person who would want to learn more about investing in annuities in Canada. But…

Tangerine Bank Review 2025

While our EQ Bank Review details why it is our top pick for Canada’s best online bank and high interest savings account, Tangerine is our…

4 Steps for a Worry Free Retirement Course Review by Frugal Trader

It’s not every day that one of your co-writers pens the first online course for retirement in Canada. Naturally, it only felt right that the…

4 Steps to a Worry-Free Retirement in Canada

I’ve been writing about personal finance in Canada for 15 years now. This week I launched the project that was by far the best resource…

Best Bank Account for Seniors in Canada 2025

So, you’ve endured 60 years of ups and downs, booms and busts, triumphs and challenges, now it’s time to kick up your feet, relax, and…

Bond ETFs vs GICs vs High Interest Savings Accounts

For income-oriented Canadian investors the choice between a Bond (or Bond ETF), a GIC, or a high interest savings account has become more important than…

TFSA vs RRSP- Which One is Better?

Canadians have fantastic options when it comes to registered accounts. Registered accounts are beneficial for many reasons, the main reason being that they are tax…

"I've completed my million dollar journey...

Want some help with yours?”

Instantly download our free eBook on tips for how to organize your RRSP, TFSA, and other investments, in order to get the most out of your retirement at any age.